19+ Va mortgage lenders

Lenders Handbook - VA Pamphlet 26-7. As previously mentioned these aspects include your income and assets debt-to-income ratio and credit score.

2

These loans can be used as strictly cash at closing to payoff debt make home improvements and pay off liens.

. This monthly payment protects the bank against the risk of loan non-payment. VA loans can help you buy a home refinance a home or get cash from your homes equity to spend on renovations or education. With a VA cash out refinance you might be able to get a new VA mortgage for 175000 plus 50000 in cash.

For example pretend your current mortgage balance is 125000. During the COVID-19 national emergency however if you were current on your mortgage when the COVID-19 forbearance was granted your mortgage company should report your account as current. Of course youll want to compare official Loan Estimates to see which loan makes most sense for you and your family but youll also want to interview.

Chapter 1 Lender Approval. We can help you understand the benefits of VA loans and empower you on your homeownership journey. They are backed by the Department of Veterans Affairs VA and offered by private lenders like Freedom Mortgage.

It may be that your mortgage company has to. Save 1440 No Lender Fee. In the US the Federal government created several programs or government sponsored.

This may not apply if you were already behind on your mortgage when the COVID-19 forbearance was requested. Keep more in the bank each month. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac.

Most lenders will use the conventional loan limits as a guide. Start saving thousands in interest and put money in your pocket. Eliminate Your Mortgage Insurance.

Received mostly positive reviews from homeowners who have used its services and has consistently ranked among the top mortgage. What Mortgage Lenders Look for in Borrowers. These refinances let you replace your current mortgage with a new VA mortgage for a higher amount and get the difference in cash when you close your new loan.

VA A VA loan is a mortgage loan available through a program established by the United States Department of Veterans Affairs. Real Estate Agents Mortgage Lenders Hard Money Lenders Insurance Contractors Investment Companies Build Your Team. If you want to find the best loan for you the Consumer Finance Protection Bureau recommends talking to at least three different lenders when shopping for a mortgage to compare loan options.

It is only required on a typical conforming mortgage if you pay less than 20 down until you have at least 22 equity in the home or 20 equity and you request the fee removed. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Mortgage industry is seeing its first lenders go out of business after a sudden spike in lending rates and the wave of failures thats coming could be the worst since the housing bubble.

Shorten the life of your loan. Ideally 620 and up has flexible credit standards. Private Mortgage Insurance PMI 0 to 1.

To be eligible for a home loan you must meet certain standards that indicate you are a capable borrower. Has appeared in the top 30 of Fortunes list of 100 Best Companies to Work For during the past 19 years ranking 7 on the 2022 list. If rates go down by 075 within 2 years refinance for free.

Apply for and manage the VA benefits and services youve earned as a Veteran Servicemember or family memberlike health care disability education and more. The Department of Veterans Affairs VA Cash-Out Refinance Loan is for homeowners who want to trade equity for cash from their home. NerdWallets Best Texas Mortgage Lenders in 2022.

The USDA maintains a list of approved lenders for USDA loans which includes online lenders and banks with branches nationwide as well as small-town banks and credit unions. Best for first-time home buyers and online experience. Best for online experience.

What Are Current Mortgage Rates. The Cash-Out Refinance Loan can also be used to refinance a non-VA loan into a VA loan. Pay Off Your Mortgage Faster.

2

Ex 99 1

G28961bci001 Jpg

Types Of Home Loans For Buyers Owners Amerisave Mortgage

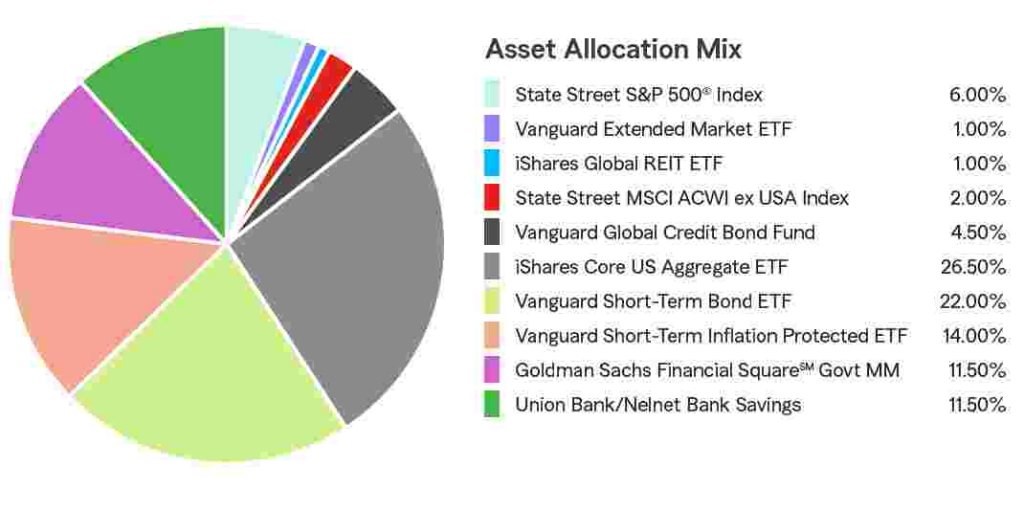

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

How To Choose 529 Plans For Your Child S Education Moneygeek Com

Rachel Eben Olive Branch Ms Mortgage Lender Trustmark

Corey Vandenberg Mortgage Loan Officer Lake State Mortgage Linkedin

Types Of Home Loans For Buyers Owners Amerisave Mortgage

Ex 99 1

Lenea Waldman Tupelo Ms Mortgage Lender Trustmark

2

2

2

Covid 19 Marvin Lim For Ga

2

2